Navigating Tariff Challenges: How China's High Pressure Hydraulic Pump Industry Thrives Amidst Trade Tensions

In the midst of escalating trade tensions and reciprocal tariffs between the United States and China, the High Pressure Hydraulic Pump industry stands out as a remarkable case of resilience and growth. According to a recent report by MarketsandMarkets, the global market for hydraulic pumps is projected to reach $40 billion by 2024, demonstrating a compound annual growth rate (CAGR) of 5.3%. This growth trajectory is particularly pronounced in China, where the high pressure hydraulic pump sector has adapted through innovation and strategic partnerships. Despite the imposition of tariffs, Chinese manufacturers have leveraged cost efficiencies and advanced technologies to enhance their competitive positioning. As they navigate these challenges, the industry's ability to thrive serves as a testament to the dynamic nature of global trade and the importance of adaptability in the face of adversity. This blog will explore the strategies that have enabled China's high pressure hydraulic pump industry to not only survive but flourish amidst the complexities of current trade dynamics.

Strategies for Resilience: How Chinese Hydraulic Pump Manufacturers Adapt to Tariff Policies

In the face of escalating trade tensions and stringent tariff policies, China's high pressure hydraulic pump manufacturers have developed a variety of strategies to enhance their resilience. One key adaptation has been the investment in research and development. By advancing their technology, manufacturers are not only improving product efficiency but also reducing production costs. This innovation enables them to maintain competitive pricing in international markets despite the financial pressures imposed by tariffs.

Another crucial approach has been the diversification of supply chains. Chinese manufacturers are actively seeking alternative suppliers for raw materials, reducing dependency on any single country. This strategic move not only mitigates risks associated with tariffs but also enhances their bargaining power. Additionally, many companies are expanding their presence in emerging markets where trade barriers are less stringent. By fostering relationships with local distributors and adapting products to meet regional preferences, these manufacturers are effectively navigating the complexities of global trade while ensuring sustainable growth.

Market Growth Analysis: The Surge in China's High Pressure Hydraulic Pump Exports Despite Tariff Barriers

In recent years, China's high pressure hydraulic pump industry has experienced remarkable growth, with exports soaring despite the imposition of tariff barriers. This resilience can largely be attributed to several factors, including technological advancements and a robust domestic manufacturing base. Chinese manufacturers have invested heavily in research and development, enabling them to produce high-quality pumps that meet international standards while remaining competitively priced. This has allowed them to capture a significant share of the global market, even in the face of trade tensions.

Additionally, the demand for hydraulic pumps in various sectors, such as construction and mining, continues to rise, further boosting China's export potential. The industry's ability to adapt to changing market conditions and innovate in response to customer needs has played a crucial role in its sustained growth. As global companies seek reliable suppliers, China's high pressure hydraulic pump exports are not just surviving; they are thriving, demonstrating the industry's capacity to navigate the complexities of international trade effectively.

Navigating Tariff Challenges: How China's High Pressure Hydraulic Pump Industry Thrives Amidst Trade Tensions

| Year |

Export Volume (Units) |

Export Value (Million USD) |

Main Export Markets |

Average Tariff Rate (%) |

| 2019 |

150,000 |

200 |

USA, Germany, Japan |

15 |

| 2020 |

175,000 |

220 |

USA, United Kingdom, Brazil |

18 |

| 2021 |

200,000 |

300 |

Canada, Australia, India |

20 |

| 2022 |

250,000 |

450 |

Germany, South Korea, Singapore |

22 |

| 2023 |

300,000 |

550 |

USA, Japan, UAE |

25 |

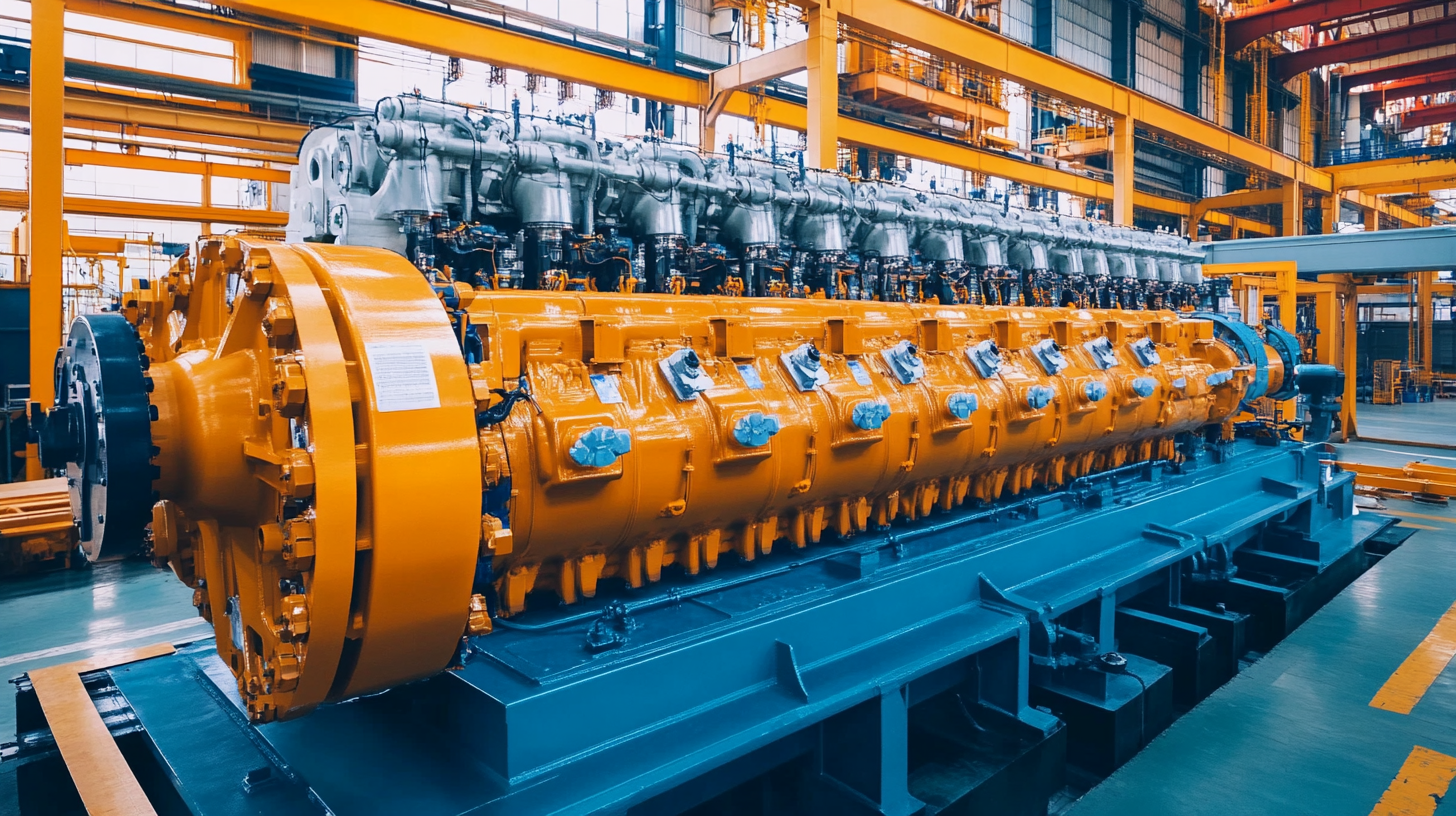

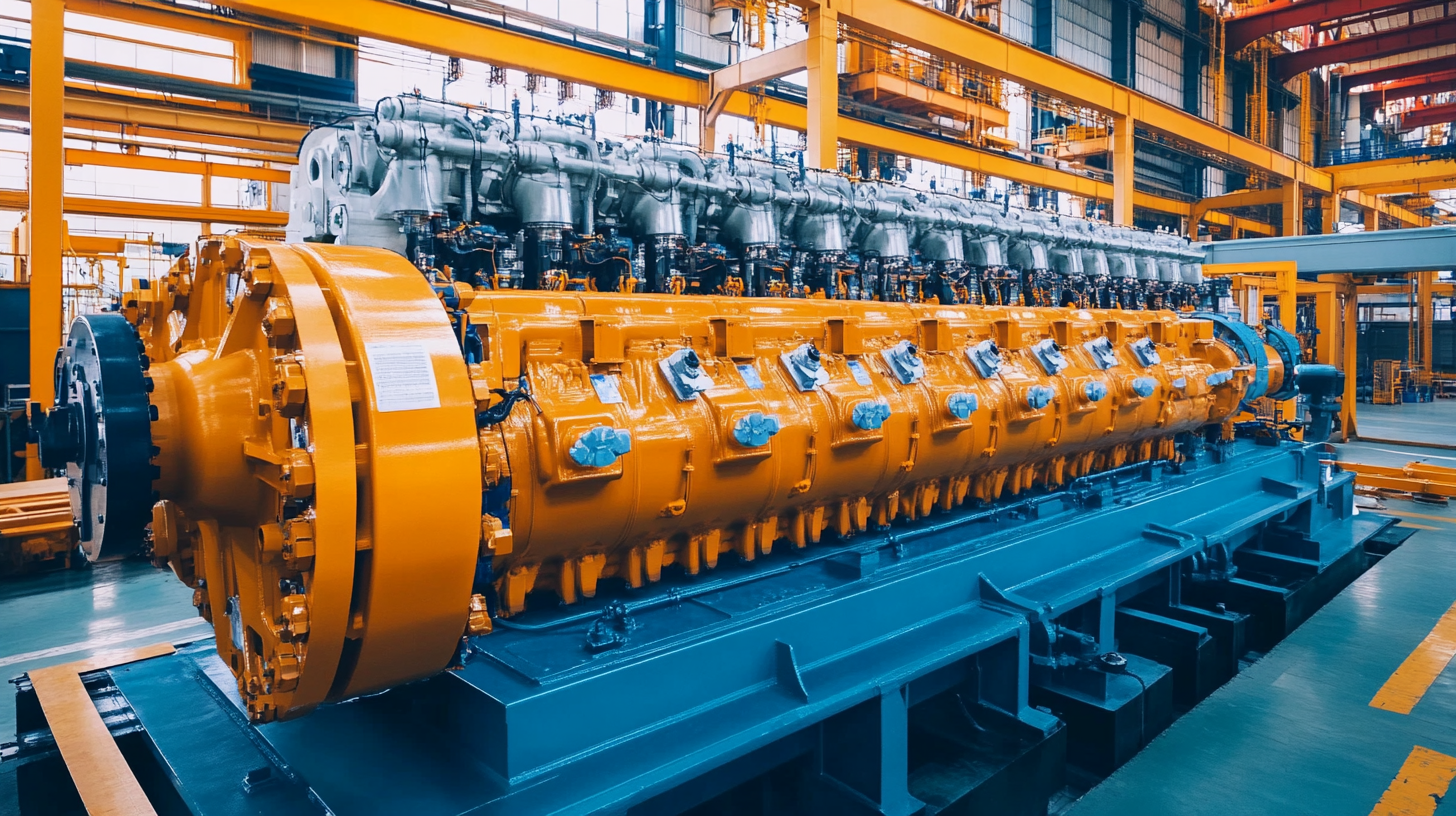

Technological Advancements: Innovations Driving China's Hydraulic Pump Industry Forward Amidst Trade Disputes

Amid ongoing trade tensions, China's high pressure hydraulic pump industry is not merely surviving; it's thriving through a wave of technological advancements. Innovations in design and production techniques have allowed manufacturers to enhance efficiency and performance, enabling them to produce pumps that meet the diverse needs of global markets. Advanced manufacturing methods, such as automation and precision engineering, have significantly reduced production costs while increasing product reliability, positioning Chinese firms as competitive players even when faced with tariffs.

Furthermore, research and development investments are driving the acceleration of new product features, including smart technology integration and enhanced energy efficiency. These innovations not only improve the functionality of hydraulic pumps but also align with global sustainability trends, making them more attractive to environmentally conscious clients. By leveraging technology, China's hydraulic pump industry is not only addressing current trade challenges but is also setting a foundation for future growth in an increasingly competitive landscape.

Competitive Landscape: Evaluating China's Position in the Global Hydraulic Pump Market Under Trade Pressure

China's high pressure hydraulic pump industry stands resilient amidst global trade tensions, carving out a significant position in the competitive landscape. Recent reports from the International Hydraulic Pump Association indicate that China's hydraulic pump production capacity exceeded 1.5 million units in 2022, making it the largest producer globally. This remarkable output reflects not only the country's manufacturing prowess but also its strategic investments in technology and innovation, allowing Chinese companies to meet rising domestic and international demands.

Furthermore, China’s hydraulic pump market is projected to grow at a compound annual growth rate (CAGR) of 8% from 2023 to 2028, according to a market analysis by Research and Markets. This growth trajectory highlights the increasing application of hydraulic systems across various sectors, including construction, agriculture, and automotive. Despite facing tariff challenges, Chinese manufacturers are enhancing their product offerings through R&D initiatives, thus reinforcing their competitive edge. As a result, Chinese firms are not only maintaining market share but also expanding into emerging markets, showcasing their adaptability in a fluctuating global environment.

Navigating Tariff Challenges: China's Hydraulic Pump Industry

Future Outlook: Predicting Trends for China's Hydraulic Pump Industry in a Tariff-Ridden Environment

China's hydraulic pump industry is navigating the complexities of a tariff-laden environment with resilience and adaptability. With forecasts from the International Monetary Fund predicting a global economic growth slowdown of 2.8% in 2025, the pressure on manufacturers is palpable. Nevertheless, statistics reveal that China's economy demonstrated unexpected strength, opening 2025 with a growth rate of 5.4%. This shift, driven by the dual forces of traditional industry upgrades and the rise of emerging business models, showcases the potential for sustained growth even amid escalating trade tensions.

Tip: Emphasizing quality and innovation is essential for businesses to compete effectively under tariff constraints. Companies should focus on enhancing product features and exploring new technological advancements to attract consumers.

As trade tensions continue to evolve, industry experts warn of potential risks accumulating, such as a shift in global supply chains and a decline in export confidence. The collective response from Asia-Pacific countries to bolster economic collaboration highlights the importance of strategic alliances in mitigating the adverse effects of tariffs.

Tip: Diversifying supply chains can help mitigate risks associated with trade policies. Companies should consider exploring new markets and establishing partnerships to ensure business continuity and market presence in these challenging times.

Navigating Tariff Challenges: China's Hydraulic Pump Industry Insights